How to Improve Your Credit Score Fast (Even If You’re Starting Low)

How to Improve Your Credit Score Fast (Even If You’re Starting Low)

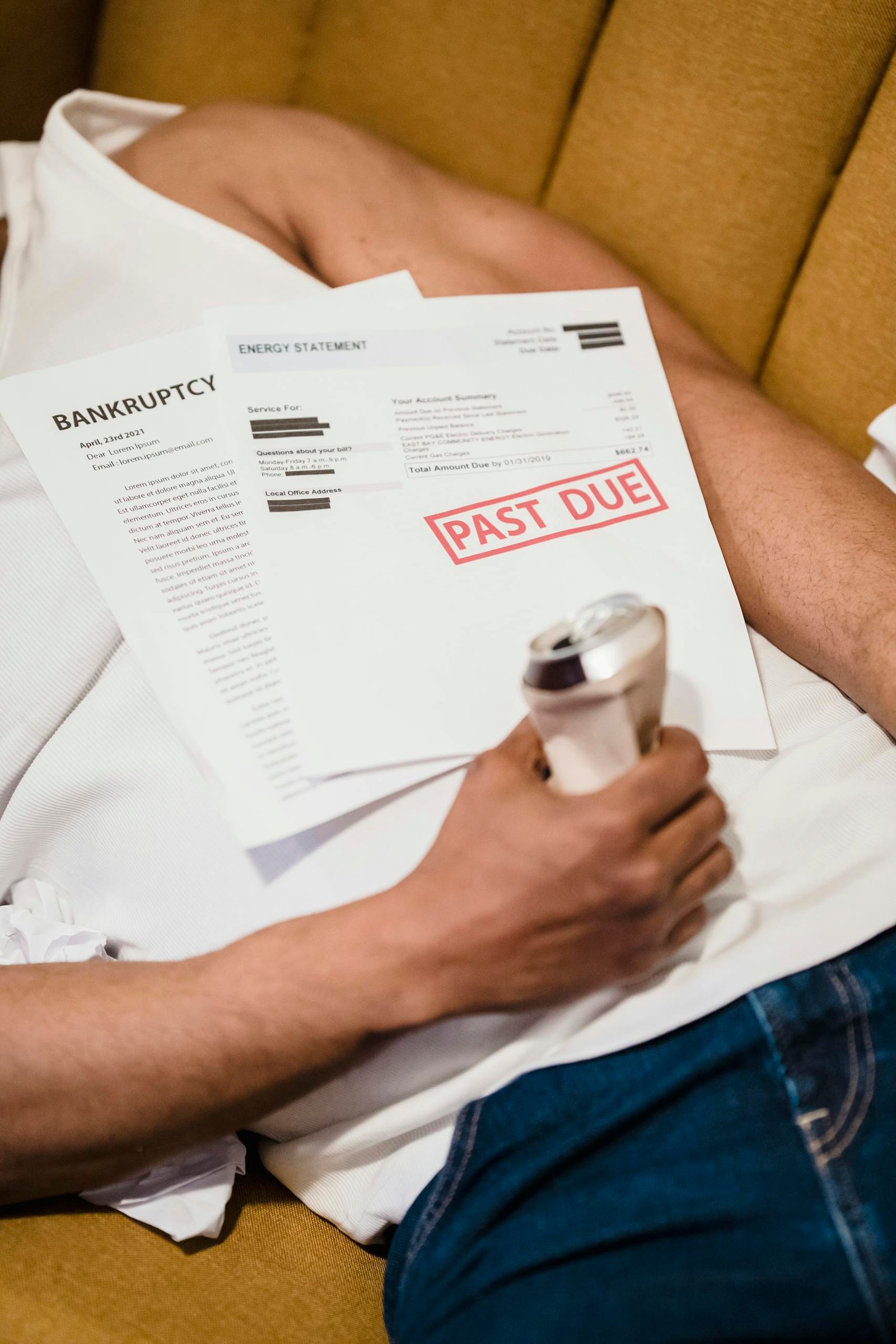

Your credit score affects everything — from getting approved for a credit card to securing a mortgage or even landing that dream apartment. If your score is on the low side, don’t worry. With the right strategy, you can see real improvements faster than you think. Here’s a practical, step-by-step guide to boosting your credit score quickly — even if you’re starting from scratch or rebuilding after setbacks.

Understand What’s Holding You Back

Start by checking your credit report from all three major bureaus — Experian, Equifax, and TransUnion. Look for:

- Errors or outdated information: Dispute incorrect late payments or closed accounts showing as open.

- High credit utilization: Try to keep your usage under 30%, and ideally below 10%.

- Delinquencies or collections: Note which debts are hurting your score most.

Pay Down Balances Strategically

Credit utilization makes up about 30% of your score, so paying down revolving balances (like credit cards) can deliver one of the fastest boosts.

- Focus on high-interest cards first.

- Make multiple payments per month to keep balances low.

- Ask for a credit limit increase — but don’t use it to spend more.

Never Miss a Payment

Payment history is the most important factor in your score — about 35%.

- Set up autopay for at least the minimum due.

- Use calendar reminders to avoid missing due dates.

- If you’ve missed payments before, get current as soon as possible. Recent on-time streaks help more than you might think.

Add Positive Accounts

You can’t erase the past overnight, but you can add new, positive data to your credit file.

- Apply for a secured credit card if you’re rebuilding.

- Use credit-builder loans or self-reported tools (like Experian Boost) that add utility or rent payments to your credit report.

- Become an authorized user on someone else’s well-managed account.

Best Tools to Build Credit Fast

| Product | Type | Key Benefit | Ideal For |

|---|---|---|---|

| Capital One Platinum Secured | Secured Credit Card | Reports to all 3 bureaus; refundable deposit | Beginners building credit |

| Discover it® Secured | Secured Credit Card | Cash back + no annual fee | Rebuilders who spend responsibly |

| Experian Boost | Free Tool | Adds utility & phone payments to your report | Quick score lift |

| Credit Karma | Monitoring Service | Real-time updates and recommendations | Ongoing tracking |

| Self Credit Builder Loan | Credit Builder | Builds credit + savings at once | Those with limited history |

(Affiliate disclaimer: This article may contain affiliate links. If you sign up through them, we may earn a small commission at no cost to you.)

Keep Old Accounts Open

Credit age counts for around 15% of your score.

- Avoid closing your oldest accounts, even if you don’t use them often.

- Keep them active by making a small purchase every few months and paying it off.

Limit Hard Inquiries

Every new credit application can cause a small, temporary dip.

- Only apply for new credit when you need it.

- Space out applications by at least three to six months.

Monitor Your Progress

Use free credit monitoring tools to track your score and alerts for suspicious activity.

- Check your report monthly to make sure positive changes are reflected.

- Celebrate small improvements — a 10-point jump can lead to better interest rates.

7 Steps to Improve Your Credit Score Fast

- Pull your credit reports and find errors.

- Pay down high balances to reduce utilization.

- Set up automatic payments for all accounts.

- Open a secured credit card or builder loan.

- Keep your oldest accounts active.

- Avoid unnecessary new credit inquiries.

- Track your score every month and stay consistent.

Common Credit Mistakes to Avoid

- Closing old credit cards: This shortens your credit history.

- Applying for too many cards at once: Too many hard pulls can drop your score.

- Ignoring small collections: Even minor unpaid debts can hurt.

- Paying late even once: A single late payment can stick for years.

- Using all available credit: Keep balances below 30% of your limit.

FAQ

Q: How fast can my score improve?

A: Many people see noticeable improvement within 30–60 days with consistent action.

Q: Should I pay off all my credit cards at once?

A: Paying them down helps, but leave a small balance reported to show active credit use.

Q: Can I raise my score without a credit card?

A: Yes — use rent-reporting tools, credit-builder loans, and utility payment reporting.

Q: What if I’ve already tried everything?

A: Consider consulting a reputable credit repair service — but always research to avoid scams.

Q: Does checking my own credit hurt my score?

A: No. Soft inquiries like personal checks have zero impact.