Why Did My Credit Score Drop Suddenly? 10 Hidden Reasons

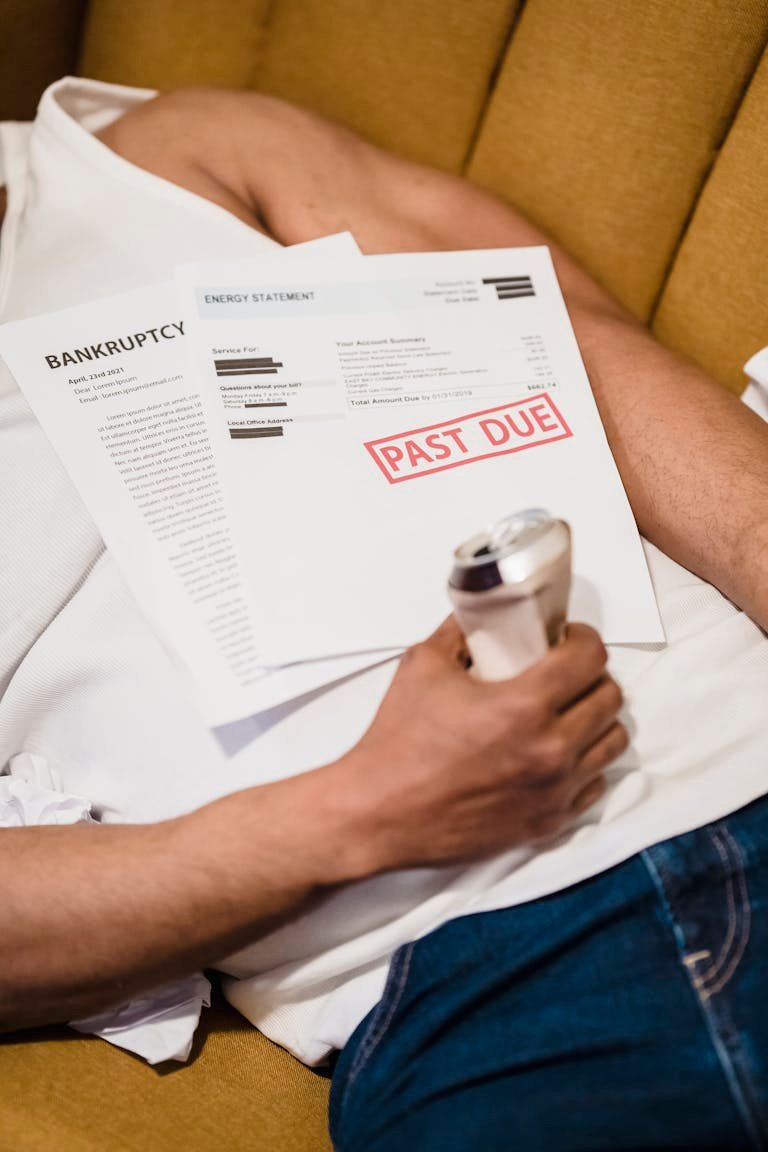

Wondering why your credit score suddenly dropped? Discover 10 hidden reasons behind unexpected score dips — from credit utilization changes to reporting errors — and learn how to fix them fast.